Fortunately in the world of reverse mortgages you do not need a wonderful credit score. Even though credit is not a factor in the approval of the reverse mortgage loan an underwriter will look for several items that may be shown on the report. The list includes items such as Federal debts or a judgement lien which must be paid at closing. It is important to have good credit but those who are interested in the reverse mortgage need not worry about their score!

For today’s conventional home buyers and refinancing households, the value of “good credit” has never been higher.

For today’s conventional home buyers and refinancing households, the value of “good credit” has never been higher.

Mortgage approvals hinge on your FICO score, as does your final mortgage pricing.

If you’re shopping for a home in California , therefore, or contemplating a refinance, be aware of how everyday credit behaviors can affect your FICO. Even small events can make a big impact.

Here are some common-sense steps to help improve your credit score.

First, keep a “cushion” on your credit cards.

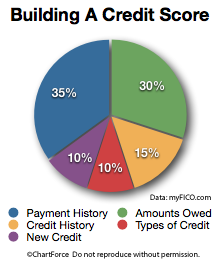

30 percent of your credit score is linked to “Amount Owed” and a big part of Amount Owed is a raw calculation of (1) What you owe in dollar terms, against (2) How much credit you have at your disposal. The credit bureaus want to see at least 70% of your credit “available”.

If you can keep your cards at least 70% available, your credit scores should improve.

For example, if all of your credit cards give you access to a combined $50,000 and you are using $10,000 of that available credit, you have 80% of your credit available to you and this is “good”.

Raise your balances to $30,000 and this is “bad”.

Second, don’t make major purchases on credit prior to making a mortgage application. This includes opening a store charge card to save 10 percent or more on a washer/dryer set, for example; or for any other appliance or furniture piece.

The reasons why are two-fold. One, store charge cards are often opened with a limit matching your initial charge, rendering them 100% utilized. This is bad for a FICO, as discussed above. And, two, opening a new charge cards has a negative FICO impact anyway.

Charge cards are associated with high default rates.

Third, make all of your monthly payments on time — even the ones in dispute. You may not want to pay that $80 wireless phone bill, for example; the one that you think you owe, but remember that Payment History accounts for 35% of your credit score. Even one late payment — or payment in collection — and your credit score can drop.

It’s often less expensive to pay a bill in dispute than to be relegated to a higher mortgage rate. The payment is dispute is remedied today. The payment on that mortgage rate lasts for 30 years.